Buying apartments in Downtown Dubai

The Dubai-Real.Estate website features over 1162 listings with detailed descriptions, photos and cost of apartments in Downtown Dubai. Each listing is manually verified, ensuring that users access only accurate and current information. To find a property that matches your preferences and investment goals, follow this guide:

- Open the advanced search system and choose your preferred property parameters: area, number of bedrooms and bathrooms, floor level, furnishings, amenities, location and construction stage etc.

- Sort the search results for easier browsing. Listings can be arranged by popularity, name, date of publication or by price (ascending or descending).

- Carefully review the available information about the selected property in Downtown Dubai and leave your contact details. The agency or developer will contact you directly to address your questions and discuss a potential deal.

Types of apartments in Downtown Dubai

The following types of property for sale in Downtown Dubai are available for buyers:

- Studio apartment. Compact units designed for one or two residents. The sleeping area, living room, kitchen and dining space are combined into a single functional zone, maximising the use of limited space. A studio in Downtown Dubai is highly attractive to professionals working in nearby business districts and its relatively easy to resell.

- Apartments with separate bedrooms. The most common housing style includes individual bedrooms, spacious living areas and either an open or closed kitchen. Premium units often feature walk-in closets, staff rooms and extra bathrooms. These apartments are highly sought after by families and long-term tenants, providing stable rental income and high liquidity.

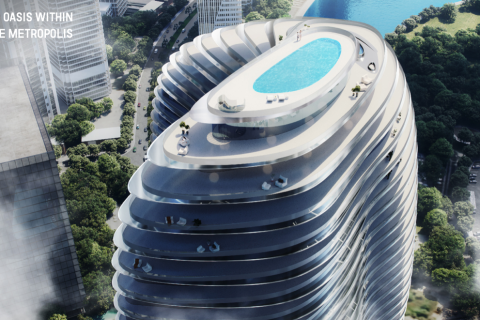

- Penthouses for sale. Apartments located on the top floors of high-rise residential projects, featuring spacious layouts, panoramic windows with views of local landmarks, private terraces and exclusive amenities such as swimming pools, Jacuzzis and private elevators. Interiors generally feature multiple en-suite bedrooms, walk-in wardrobes, home offices, laundry rooms, storage spaces and staff quarters. The penthouse market is limited, making these properties for sale exclusive and highly valuable assets.

- Duplexes and triplexes. These offer 2- and 3-storey apartments with communal areas on the lower levels and private sections above. These layouts often feature double-height living rooms, internal staircases and multiple terraces. Valued for their privacy and distinctiveness, these properties remain in steady demand among buyers and renters seeking unconventional homes.

- Podium townhouses and villas. Situated on the lower levels of buildings, these units blend the privacy of a standalone house with access to the amenities of a residential complex. Layouts include private entrances, personal terraces or gardens and occasionally even pools. Because they are scarce in central locations, these properties are regarded as highly liquid assets.

- Serviced apartments. Fully finished and furnished apartments managed by a professional company. Residents enjoy hotel-style services like 24/7 concierge, cleaning, personal trainers, drivers, chefs and more. For investors, this format offers minimal operational costs and stable occupancy rates thanks to expert property management.

Popular off-plan projects in Downtown Dubai for buying flats

| Off-plan projects | Developer | Completion date | Starting price | Apartment types | Amenities |

|---|---|---|---|---|---|

| Sofitel Residences | Azha Development | Q4 2026 | AED 2.5 million (USD 680,500) | 1- to 3-bedroom apartments and 4- and 5-bedroom penthouses for sale in Downtown Dubai | Immersive cinema, swimming pool, gym, dry cleaning and laundry services, concierge, childcare and pet walking services. |

| W Residences Dubai | Dar Al Arkan | Q4 2025 | AED 1.8 million (USD 490,000) | 1- and 2-bedroom apartments and 3- and 4-bedroom penthouses | Gym, yoga and stretching studios, spa, playground, cinema, coworking space, professional recording studio, BBQ area and rooftop lounge. |

| One Residence | Ginco Properties | Q1 2027 | AED 1.27 million (USD 346,000) | Studios and 1- to 4-bedroom apartments | BBQ areas, adult and kids’ pools, cinema, coworking space, golf simulator, green areas, playground, music room, gym, trampoline zone and valet service. |

| Society House | Invest Group Overseas | Q3 2026 | AED 1.42 million (USD 386,000) | Studios, 1- to 3-bedroom apartments and 3-bedroom penthouses | 25-metre swimming pool, cinema, CrossFit studios, golf simulator, gym, playground and padel tennis court. |

| Elegance Tower | Damac Properties | Q1 2026 | AED 1.79 million (USD 487,500) | 1- and 2-bedroom apartments | Pool, gym with modern equipment, spa, playground, restaurant, landscaped leisure areas, 24/7 security and surveillance system. |

Lifestyle and amenities

Downtown Dubai is designed as a self-sufficient district with key facilities for living, working and leisure located within walking distance. It’s home to the Dubai Mall, which serves not only as a retail centre but also as a bustling urban area combining shopping, entertainment and dining.

The cultural landmarks of the district include the Burj Khalifa, the Dubai Fountain and the Dubai Opera, which are major tourist attractions. Business activities are supported by office clusters like Emaar Square.

Hospitality infrastructure features flagship hotels like Armani Hotel and Address Downtown, as well as several other premium brands. The area is crowded with fine-dining restaurants and concept cafes, many offering panoramic views of the city centre. Burj Park and landscaped boulevards provide leisure spaces for walking and events.

Residents also benefit from extensive social infrastructure. Healthcare services are provided by clinics such as Aster Royal Clinic, Mediclinic, Al Borj Medical Centre and J'Adore Medical Clinic. For families, one of the key advantages is the availability of kindergartens and international schools nearby.

With its prime location in the heart of Downtown Dubai, this area offers more than just apartments for rent in Downtown, it delivers a complete lifestyle experience. Residents enjoy world-class amenities and immediate access to iconic landmarks like Burj Khalifa and Dubai Mall. Whether you are looking for short- or long-term housing, options available in Downtown Dubai cater to those seeking luxury living in one of the city’s most dynamic and desirable districts.

Accessibility and transportation

Downtown Dubai is seamlessly connected to the city’s transport network at all levels. The primary hub is the Burj Khalifa/Dubai Mall metro station on the red line, providing direct links to Dubai International Airport, business districts and residential neighbourhoods. This is enhanced by a tram line that links to Dubai Marina and Business Bay.

Surface public transport includes RTA buses that operate regularly to key city locations. For those preferring private transport, taxi services via mobile apps are readily available, with minimal waiting times. Motorists have access to underground and multi-level parking, with the largest facility situated at Dubai Mall. Proximity to Sheikh Zayed Road and Al Khail Road ensures quick access to the airport and major business hubs.

The area is also pedestrian-friendly: landscaped boulevards and covered walkways facilitate easy movement between homes, offices and entertainment venues. In recent years, micromobility has expanded rapidly with bike and e-scooter rental stations available in key locations including Mohammed Bin Rashid Boulevard.

Downtown Dubai investment potential

Apartments in this area remain one of the most stable segments of property in Dubai. In the first half of 2025, the average price of luxury property in Downtown Dubai increased by 3.1%, confirming the ongoing demand and potential for long-term capital growth. This enables investors to benefit from resale, particularly when buying during early construction stages:

- The price of apartments at the foundation stage is on average 20 to 30% lower.

- By the time construction is completed, prices typically increase, allowing capital gains to be locked in.

- Developers provide interest-free payment plans and flexible schedules that make the investment process easier.

Rental yields in the area is also noteworthy. As of 2025, the average returns are

- 5.35% for studios

- 5.77% for 1-bedroom units

- 13.7% for 2 bedroom apartments

- 19.92% for 3 bedroom apartments

- 14.47% for 4-bedroom units

These high returns are driven by steady demand across various renter profiles. Apartments in Downtown Dubai for investment are attractive to:

- Employees of international companies working in central business clusters.

- Entrepreneurs and business owners seeking prestigious locations.

- Expats who prefer living near major infrastructure facilities.

- Tourists looking for short-term rentals in the city centre.

The platform features over 1162 apartments and flats in Downtown Dubai.

Yes. Downtown Dubai apartments for sale are in one of the city’s freehold zones, which means foreign nationals can legally purchase and own property indefinitely.

Buying apartment in Downtown Dubai is popular among:

- Investors seeking profit from resale or rental income.

- Professionals working in nearby business centres and entrepreneurs.

- Expats and families wanting quick access to social infrastructure and entertainment venues.

Investing in apartments in Downtown Dubai offers a prime central location, globally recognised landmarks such as the world’s tallest building and the largest mall in the region, as well as a comprehensive infrastructure with restaurants, boutiques, wellness clubs and entertainment venues. Its well-developed transport system includes metro, buses, trams and taxis.

The starting price of an apartment in Downtown Dubai, UAE, is AED 1150000 (USD 313138).

Prices of an apartment for sale in Downtown Dubai can reach up to AED 760 million (USD 207 million).

In the first half of 2025, the average cost of luxury flats in Downtown Dubai rose by 3.1%.

Nearby alternatives include Business Bay, Jumeirah and Al Safa, which offer solid options for most property buyers.

There are currently no operational schools within Downtown itself but JSS Private School is located 15 to 20 minutes away. It follows the Indian CBSE curriculum and is popular among expats.

Nearby options include Toddler Town British Nursery, Blossom Nursery and Jumeirah International Nursery Dubai.

Medical services in the district include Aster Royal Clinic, Mediclinic, Al Borj Medical Centre and J'Adore Medical Clinic.

The highest rental yields are found in 2-, 3- and 4-bedroom units, reaching 13.7%, 19.92% and 14.47% per year, respectively. Studios and 1-bedroom apartments yield returns of 5.35% and 5.77%, respectively.

Yes. The area is highly popular among tourists, driving strong demand for short-term rental options.

Some of the most prominent agencies handling Downtown properties include:

- FAM Properties

- Haus & Haus

- Provident Real Estate

- Metropolitan Premium Properties

- Savills Real Estate

- Homes 4 Life Real Estate

- F & C Properties

From January to September 2025, over 2,500 residential units were sold in the district.